While Europe teeters on the brink of recession, Russia is emerging from one. Real-time data shows a subdued but strengthening economy (“As Europe falls into recession, Russia climbs out,” The Economist, 10/16/2022).

The Economist is about as anti-Russian and neocon of a publication as there is. A few months ago, they were saying that the Russian economy was being bolstered by their increased energy income, but was still in a precarious state. A few months before that, they were saying that the Russian economic recovery numbers were smoke and mirrors. Now they’re saying in essence, “We have to admit Russia’s recovery is for real, while Europe is headed for a collapse.”

How did this happen?

We were promised that Russia’s economy would collapse. “The ruble is rubble,” said Joe Biden. We would just have to endure a little bit of hardship and a temporary bout of inflation. When analysts pointed out that our inflation rate started to rise far earlier than the Ukraine conflict, no one in D.C. understood that it’s not all Russia’s fault. And even if we succeeded in wrecking Russia’s economy, no one stopped to ask the question as to how the collapse of the world’s largest exporter of food and fuel could be good for the global economy?

Why do we continually hear such nonsense?

It’s very simple actually. Our leaders in the West are career politicians who have not really done a honest day’s work in their life. They have absolutely no idea how macro-economics actually work. They believed the textbooks written by their neo-liberal and Marxist professors. They are idealogues driven by a narrative agenda, not by hard data and facts.

As Donald Trump always said, “Their leaders are smart and ours are dumb!”

Another Biden head scratcher: “a billion, a trillion, $750 million dollars, billion dollars off the sidelines in investment.”

The fact of the matter is that the Western globalists can no longer bully the world and cancel entire nations with economic sanctions. That’s just not the way the world works anymore. We must be clear, the coming collapse of the West is due to bad economic decisions and bad energy policies that were set in place prior to and during the COVID pandemic. The recession will only be exacerbated by the war. It’s not Russia’s fault. It would have happened anyway, but Putin has convinced the nations of the world that are not pro-Western globalists to band together and resist the sanctions. This just makes the value of the West’s unending supply global reserve currency that much smaller. The U.S. Federal Reserve can no longer print money and expect foreign nations to absorb the brunt of the inflation.

Western countries will have to do what Russia is doing. Tie our currencies to basketable commodities, lower the total national debt to one-fifth of the yearly GDP, and increase energy and natural resource production for export. It wouldn’t hurt to cut regulations and taxes on the technology sector either. Within a year or two, the United States and many other Western nations are going to be talking about national bankruptcy or austerity measures in which we can no longer borrow money from ourselves to provide stimulus money in order to jump start the economy. And this means that the government will not have buying power for a few years. We will soon have recession, falling real estate prices, and falling stock market indexes — as in 2008 levels or worse.

In other words, there will be a general collapse in the Western economy all across the boards — rich and poor. That will cause some hardship on people who will then have to fend for themselves without guaranteed credit, but within five years of the recession, we will have a more robust and growing economy than ever before because we will have based our economy on actual market forces and not fractional reserve banking nonsense.

I say this with the warning that I am not an economics expert. So don’t adjust your portfolio on my wisdom! Let’s come back to this post in six to seven years and see if I was right.

That being said, just after I hit “post” on a shorter version of this screed on my social media, I found another article in Newsweek by a self-professed liberal arts English major (like I once was) who understands more about macroeconomics than our own president, who has trouble defining the difference between a “million,” a “billion,” and a “trillion.” Yes, I know it is Newsweek, but unlike The Economist article, it is not behind a paywall. Sometimes the legacy media publishes an opinion piece by a principled conservative.

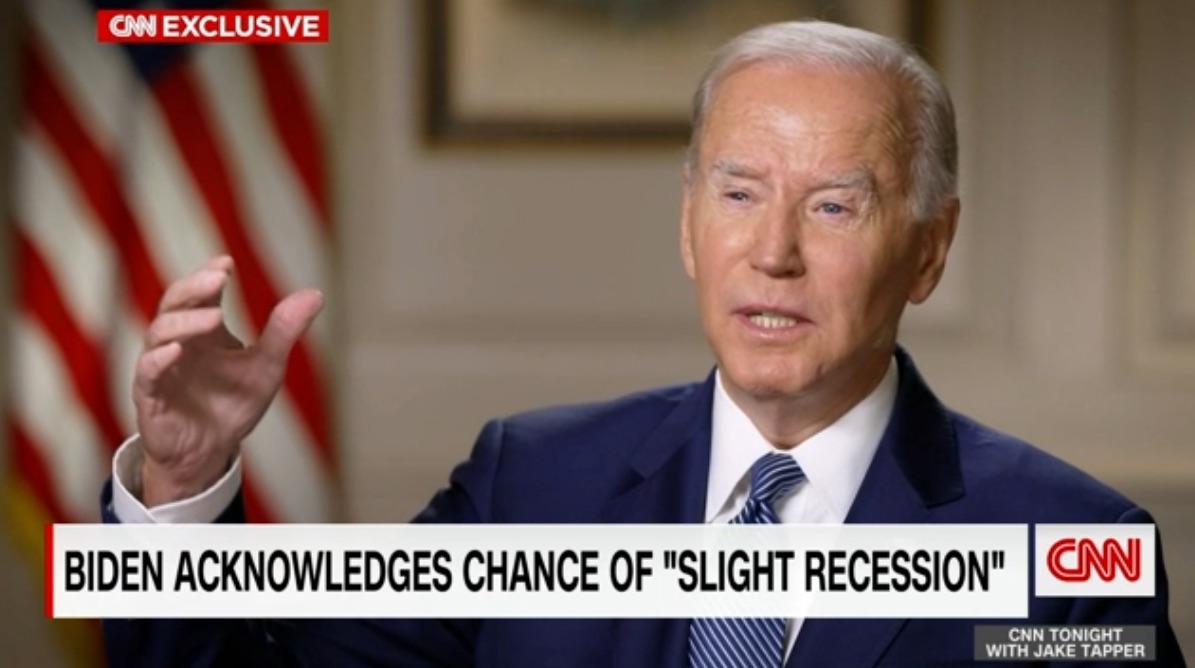

During a rare television interview this week with CNN, President Joe Biden had difficulty pinpointing just how much the misleadingly named Inflation Reduction Act would contribute to fighting climate change. He said it would spur something around “a billion a trillion $750 million dollars billion dollars off the sidelines in investment.” A bit of a head scratcher. Yet that confusion is reminiscent of what I feel when I (a humble English major) try to wrap my head around a number as large as $31 trillion. That’s what our gross national debt topped last week, a record high for the country, and one we should all be concerned about. To break it down, every person living in the United States now has a burden of more than $93,000 from the federal debt alone. Each American isn’t likely to get a bill in the mail for that amount. We will pay, however, in the form of even higher interest rates and cuts to federal programs.

It turns out that artificial intelligence understands exactly what I’ve been saying because the algorithm wanted me to read this article that says the same thing. We know exactly what is wrong and we know what to do. It’s not rocket science after all, but we might want to elect a few mathematicians and rocket scientists to Congress. Before that, as Shakespeare wrote, “First … let’s kill all the lawyers.” Then the economists.

your_ip_is_blacklisted_by sbl.spamhaus.org